.jpeg)

Meet Northern Uganda fast growing Tik Toker

Singer Pretty B set to announce 'IPE SERIOUS' concert date after Wonen shows her support.

Not Allan Smokie who ...., Spragga finally cleared the air about the rumors that he hit the studio and recorded his own song because the singer hurt words on him.

Kash Owakabi fully returns to active work after the completion of...........

The 'Burry Me in your Heart' movie premier is to happen early next month of July in Gulu, Here is what we know so far.

Oj Maxwell officially returns to the music industry, Friends and fans I finally h.......

The guy who fights hard to change Northern Uganda's music industry to celebrate 14 years in the entertainment sector, how Kash Owakabi changed the music industry in the North.

Singer Jenneth Prischa bought her first ride, she said the car cost her shilling 1.......

HOT 100

| Rank | Song | Title | View song |

|---|---|---|---|

1 |

|

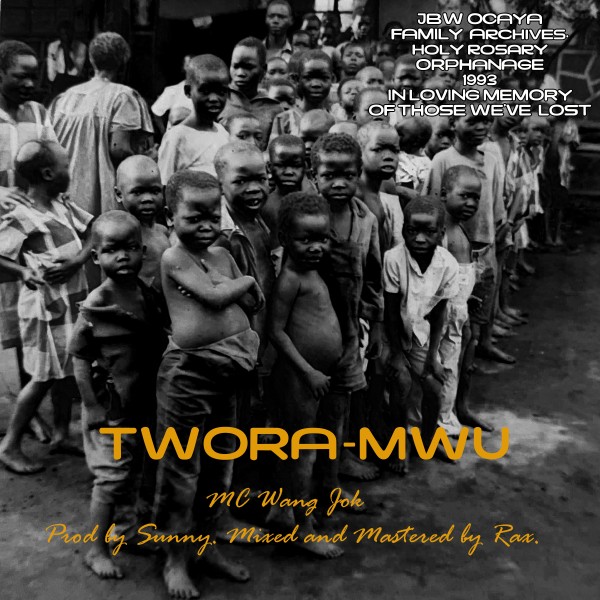

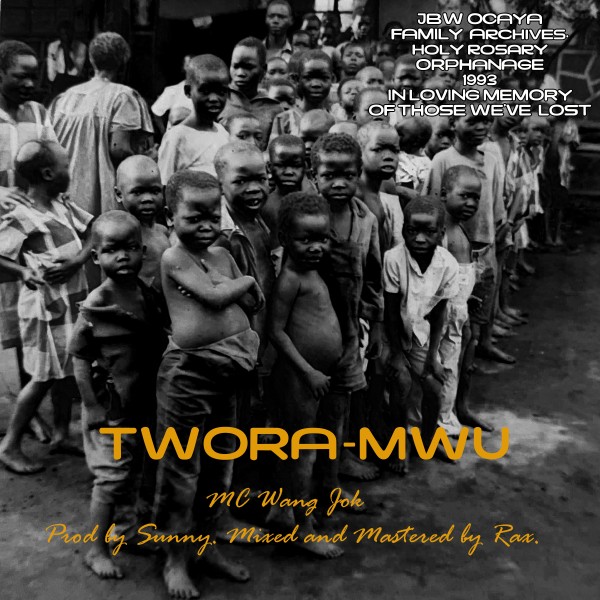

Twora Mwu - Mc Wang Jok | View Song |

2 |

|

Bebe - BL Rapper Luo Melody | View Song |

3 |

|

Blue Tick Pelare - Ricky Da Rapper Music | View Song |

4 |

|

Nyuta Yoo - King Tirus | View Song |

5 |

|

Kica Palubanga - Pretty B | View Song |

6 |

|

Soo Dari - Icon O | View Song |

7 |

|

Video Mix - DJ TECSPRO | View Song |

8 |

|

Prison Aleya - Captain Jovan Senior | View Song |

9 |

|

Soo Dari - Icon O | View Song |

10 |

|

Turn Me On - Red Muzzle Official | View Song |

11 |

|

Bin Doo By Kepaman Official Audio DJ Je Pro 256 - Kepaman | View Song |

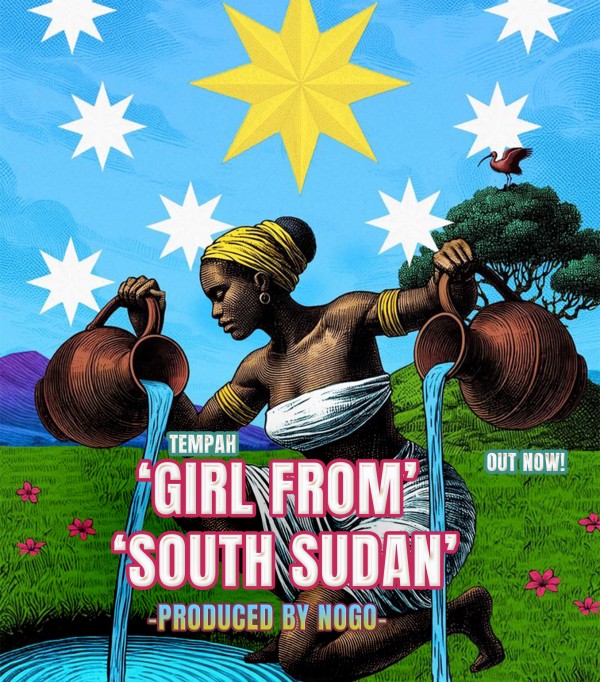

Girl From South Sudan - Tempah

Anga Tin - Guluma

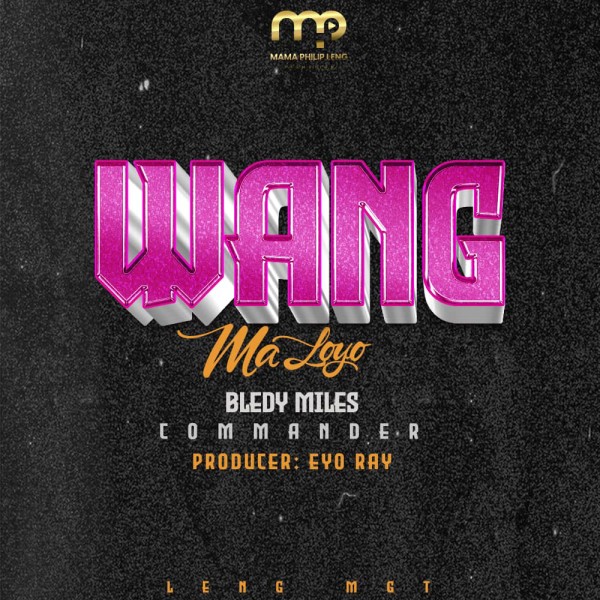

Wang Maloyo - Bledy Miles

Ding Dong - Pretty B

Catan Ngwinyi - Sam17 Ug

Classy - Timcence

What You Gon Do - Timcence

Pa Ngwang - Kamuzu Urban Niga

Bed Original - Pato Loverboy Ft Nays Official

Level Up - Timcence

Ineka Nono - Mixola

Me First - Timcence

3 Minute Pressure - Timcence

I Know - Timcence

Peroma - Peip Namah

WANG OOH - Apostle Samuel The Future

Kica Palubanga - Pretty B

Pwod Amari - Rapsody Ug

Bin Bota - Rapsody Ug

Bin Doo By Kepaman Official Audio DJ Je Pro 256 - Kepaman

KA_MYEL - SAMMAH BONGA

NEVER LATE - JO-ICE

Lapoya - CHOZEN GERNIE MACRON

Video Mix - DJ TECSPRO

JAY MELODY SHORT MIGHTY MIX - DJ TECSPRO

Short Vibez - DJ TECSPRO

Blue Tick Pelare - Ricky Da Rapper Music

Bebe - BL Rapper Luo Melody

Twora Mwu - Mc Wang Jok

Latoo Na - Captain Jovan Senior

Singer Zetive set to announce concert date, said he has been inspired by Alien Skin.

Sad as Northern Uganda singer Bongoman Acelam reportedly has been cane by Clan over his song 'Ki yuk yee'. The clan leader said the song is biased--- Ocaya claims

.jpg)

I will never play your song--Radio Rupiny presenter Alexander Okidi to singer Adong

Influencer Jacob Spragga Claims He Now Worth 36millionsUGX, Surpassed Amito

- Default

- Green

- Blue

- Pink

- Yellow

- Orange

- Purple

- Red

- Lightblue

- Teal

- Lime

- Deeporange